February 2023

The end-of-February forecasting for the RBA cash rate survey by finder.com.au brought about interesting finding. The forecasts clearly indicate the increase of the cash rate in March and until June, but then they give contradictory conclusions regarding the further developments. I interpret this instance indicating difficulties in predicting the break point, that is, the first time the RBA will not increase the rates.

Cash rate forecasts

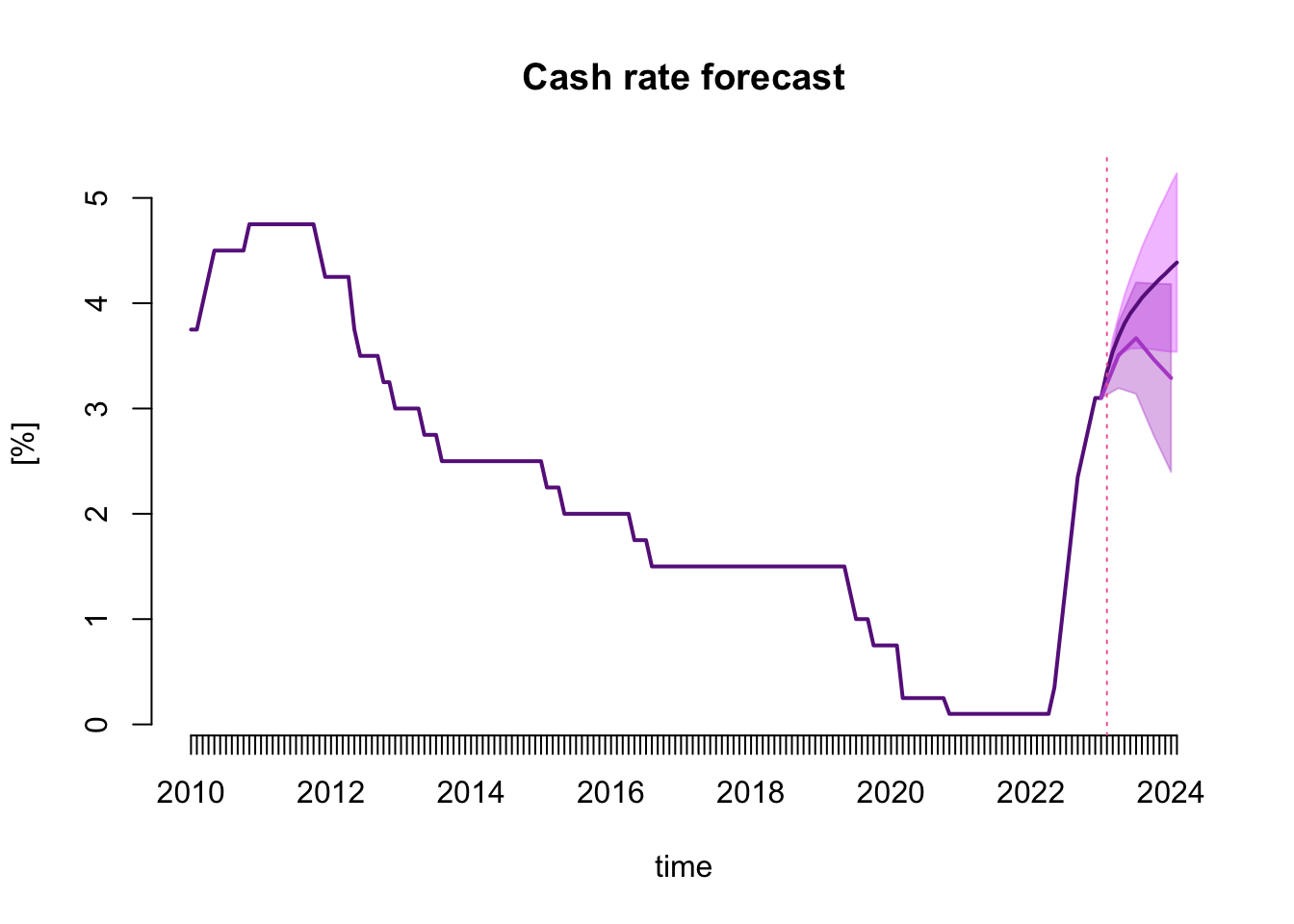

The figure below presents the monthly cash rate series starting from January 2010, with the forecasts reported from March 2023 to February 2024 as the forecast mean and the 68% forecasting intervals. These forecasts clearly indicate the increases in the first half of 2023. After that period, however, the forecasts obtained using the system of weekly and monthly cash rate target series and bond yields tell a different story than those obtained using a macroeconomic system of quarterly series. The former indicates continuing increases in the cash rate until the end of the year, whereas the latter suggests stabilisation of its level halfway through the year. This discrepancy is a strong indicator that the arrival of new data will be decisive in predicting the first month in which the RBA will not increase the interest rates and when it will start decreasing them.

The table below makes the numerical values presented in the figure more accessible.

| monthly | lower | upper | quarterly | lower | upper | |

|---|---|---|---|---|---|---|

| Mar 2023 | 3.54 | 3.41 | 3.67 | |||

| Apr 2023 | 3.68 | 3.49 | 3.88 | 3.51 | 3.19 | 3.82 |

| May 2023 | 3.81 | 3.54 | 4.07 | |||

| Jun 2023 | 3.90 | 3.57 | 4.24 | |||

| Jul 2023 | 3.98 | 3.57 | 4.38 | 3.67 | 3.14 | 4.20 |

| Aug 2023 | 4.05 | 3.57 | 4.53 | |||

| Sep 2023 | 4.11 | 3.57 | 4.66 | |||

| Oct 2023 | 4.17 | 3.56 | 4.78 | 3.47 | 2.75 | 4.19 |

| Nov 2023 | 4.23 | 3.55 | 4.90 | |||

| Dec 2023 | 4.28 | 3.55 | 5.01 | |||

| Jan 2024 | 4.33 | 3.54 | 5.13 | 3.29 | 2.40 | 4.18 |

| Feb 2024 | 4.39 | 3.54 | 5.24 |

Survey answers

Based on the forecasts above, and the analysis of forecasts from individual models, I formed the following survey answers:

When you think the RBA will change the cash rate?

| Mar 2023 | Apr 2023 | May 2023 | Jun 2023 | Jul 2023 | Aug 2023 | Sep 2023 | Oct 2023 | Nov 2023 | Jan 2024 or later | |

|---|---|---|---|---|---|---|---|---|---|---|

| Increase | ✓ | ✓ | ✓ | ✓ | ||||||

| Decrease |

Why do you think this?

My predictive systems for monthly and quarterly data unequivocally indicate further increases in the value of the cash rate by around 18 basis points in March. Moreover, the cash rate will likely increase to about 3.7 or 3.9% by June 2023. However, after that period, the forecasts give contradictory conclusions. Therefore, the arrival of new data will play a decisive role in shaping expectations for the year’s second half. My projections are available at https://donotdespair.github.io/cash-rate-survey-forecasts/

By how much do you think the RBA will change the cash rate in the next meeting?

15 pbs

By how much do you think the RBA should change the cash rate in the next meeting?

15 pbs

At what level do you think the cash rate will peak?

3.75%

When do you think the cash rate will peak?

June 2023

RBA’s decision

On 7 March 2023, the RBA announced an increase in the cash rate target by 25 basis points.

Forecasting system

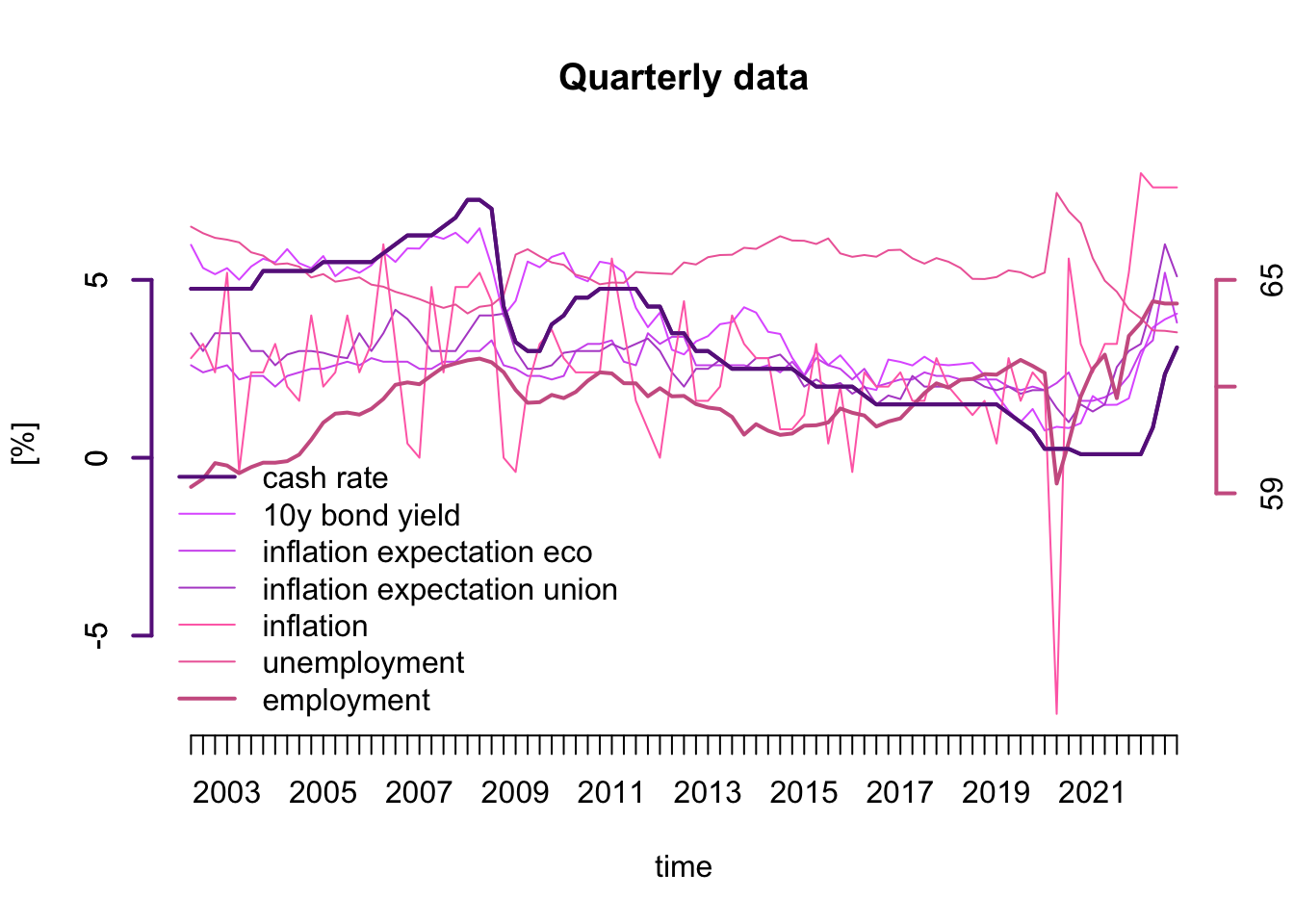

Due to an extensive research and teaching agenda for February and March I did not expand the forecasting system to prepare my answers for this month’s survey. Therefore, the forecasts using the quarterly system stayed the same as in January forecasts. The quarterly data spanning the period starting in the second quarter of 2002 and finishing in the last one of 2022 is plotted below.

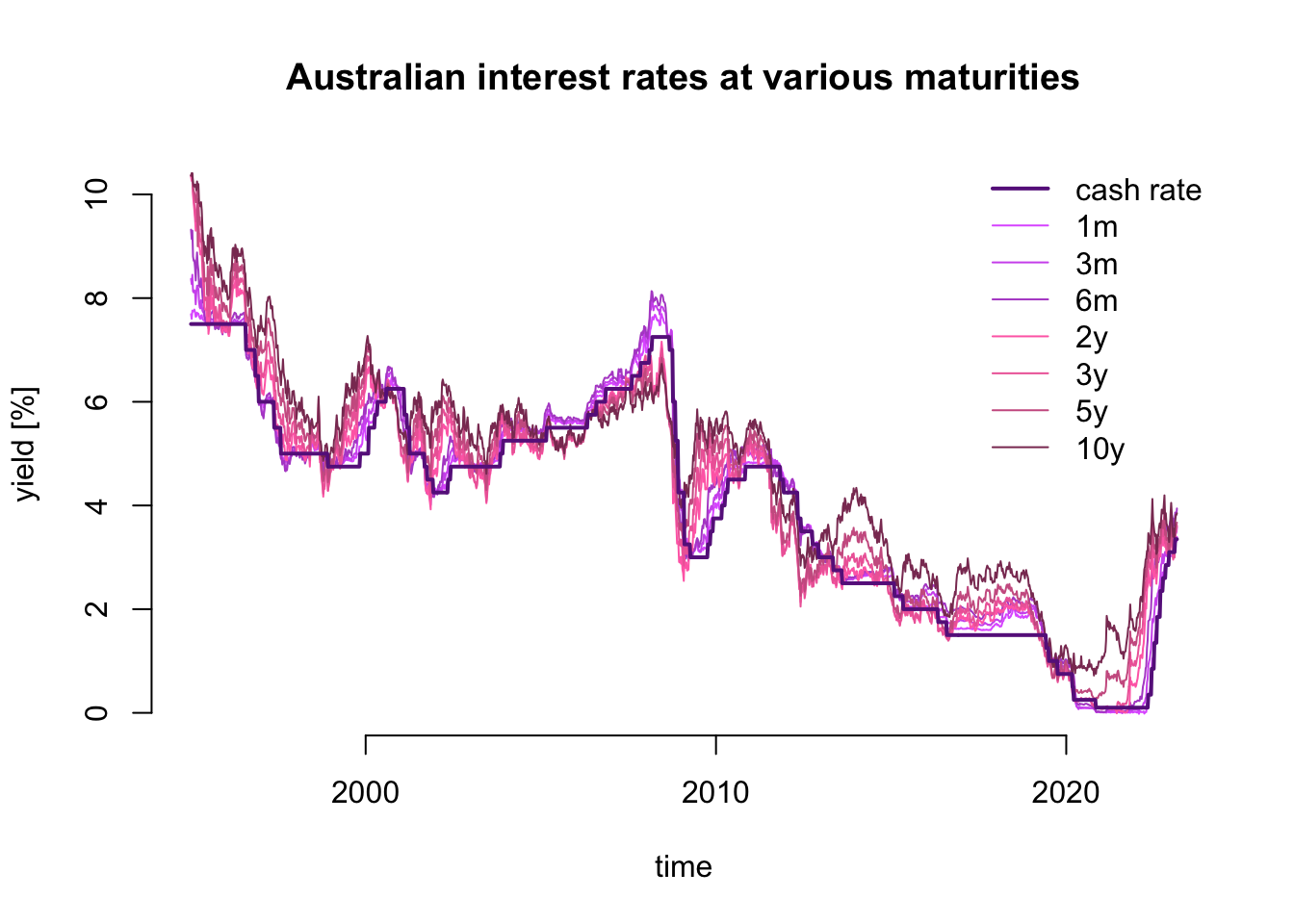

The monthly forecasts were based on the same forecasting system as the one I developed for November forecasts. The updated data is plotted below.