November 2023

The end-of-November forecasting for the RBA cash rate survey by finder.com.au follows the announcement of October quarterly inflation 4.9%.

Cash rate forecasts

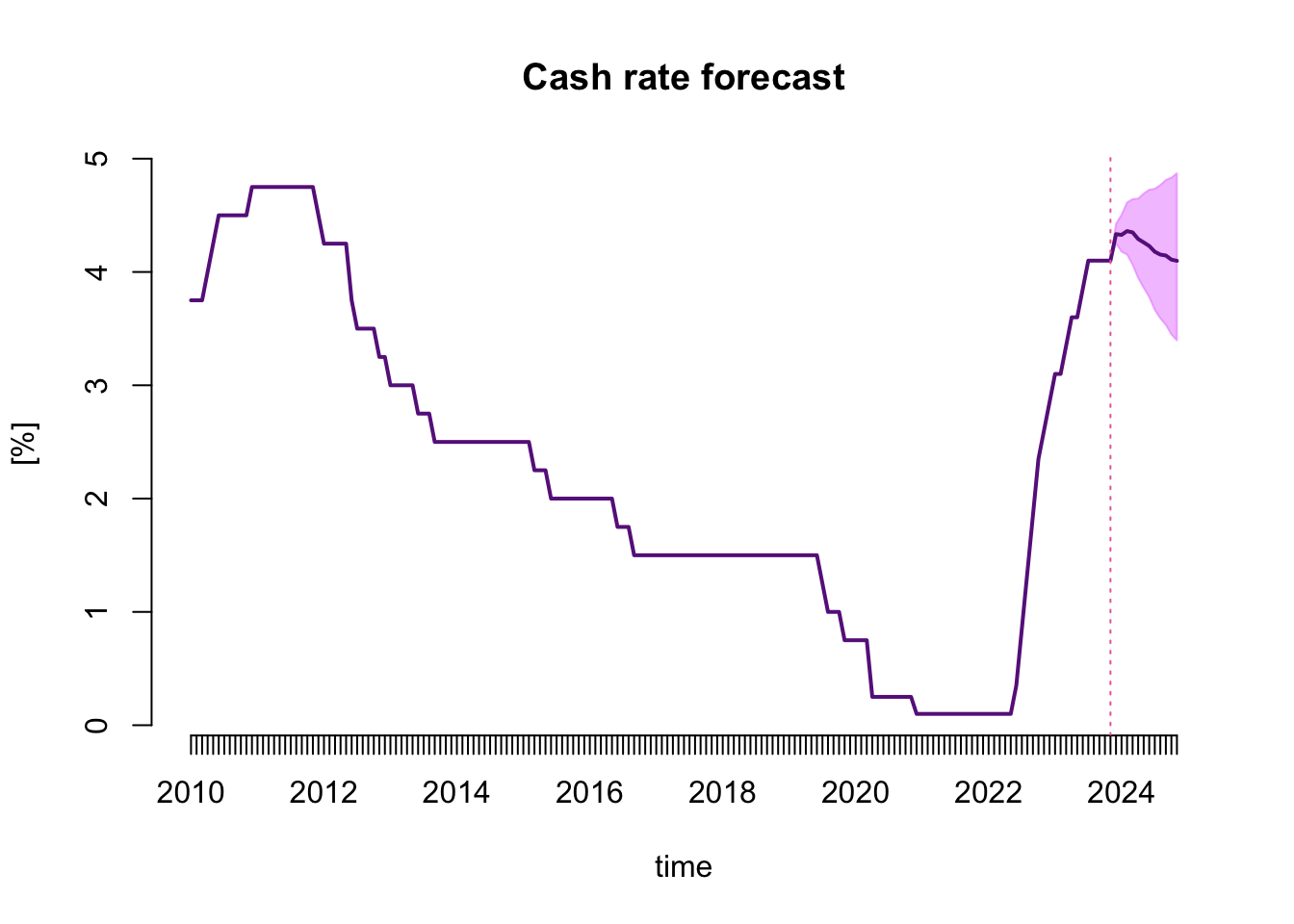

The figure below presents the monthly cash rate series starting from January 2010, with the forecasts reported from December 2023 to November 2024 as the forecast mean and the 68% forecasting intervals.

The table below makes the numerical values presented in the figure more accessible.

| monthly | lower | upper | |

|---|---|---|---|

| Dec 2023 | 4.33 | 4.25 | 4.43 |

| Jan 2024 | 4.33 | 4.18 | 4.50 |

| Feb 2024 | 4.36 | 4.15 | 4.61 |

| Mar 2024 | 4.35 | 4.06 | 4.64 |

| Apr 2024 | 4.29 | 3.95 | 4.65 |

| May 2024 | 4.26 | 3.86 | 4.69 |

| Jun 2024 | 4.23 | 3.78 | 4.73 |

| Jul 2024 | 4.18 | 3.67 | 4.73 |

| Aug 2024 | 4.15 | 3.59 | 4.77 |

| Sep 2024 | 4.15 | 3.53 | 4.81 |

| Oct 2024 | 4.11 | 3.45 | 4.83 |

| Nov 2024 | 4.10 | 3.40 | 4.87 |

Survey answers

Based on the forecasts above, and the analysis of forecasts from individual models, I formed the following survey answers:

When you think the RBA will change the cash rate?

| Dec 2023 | Feb 2024 | Mar 2024 | Apr 2024 | May 2024 | Jun 2024 | Jul 2024 | Aug 2024 | Sep 2024 or later | |

|---|---|---|---|---|---|---|---|---|---|

| Increase | |||||||||

| Hold | ✓ | ✓ | |||||||

| Decrease |

Why do you think this?

After last month’s forecasts indicating both HOLD and RAISE decisions, this month, they settled quite firmly on HOLD. The level of 4.35% is likely to stay unchanged by the second quarter of next year. This seems in line with Michele Bullock’s communication, although the domestic sources of inflation talk could indicate otherwise. My forecasts are available at: forecasting-cash-rate.github.io

By how much do you think the RBA will change the cash rate in the next meeting?

0 pbs

At what level do you think the cash rate will peak?

4.35%

When do you think the cash rate will peak?

November 2023

Forecasting system

My forecasting system for November is based on the cash rate target and government bond yields at various maturities as presented in the figure below.

The system consists of over two hundred of models. Half of them are are models of weekly and the other half of monthly data.

The novelty starting from this month is forecasting using a foreign sector represented by monthly trade weighted indices and interest rates of Australia’s closest trading partners.

Vector Error Correction models for weekly and monthly series with different model specification parameters. Univariate models for the cash rate capture complex patterns of data persistence using autoregressive moving average equation extended by time-varying volatility equation - a GARCH model. Part of the models include the leverage effect and/or time-varying risk premium.

The forecasts are pooled in two stages. Firstly, the models are weighted in four sub-groups VECM vs. ARMA and weekly vs. monthly data models proportionally to their cash rate forecasting ability. Such four pooled forecasts are equally weighted in the second stage to provide monthly forecasts reported above.