June 2023

The end-of-May forecasting for the RBA cash rate survey by finder.com.au follows the anouncement of inflation for June 2023 at the level of 5.6%. The new data leads to surprising forecasts indicating a decisive increase in the cash rate in July and subsequent increases further on.

Cash rate forecasts

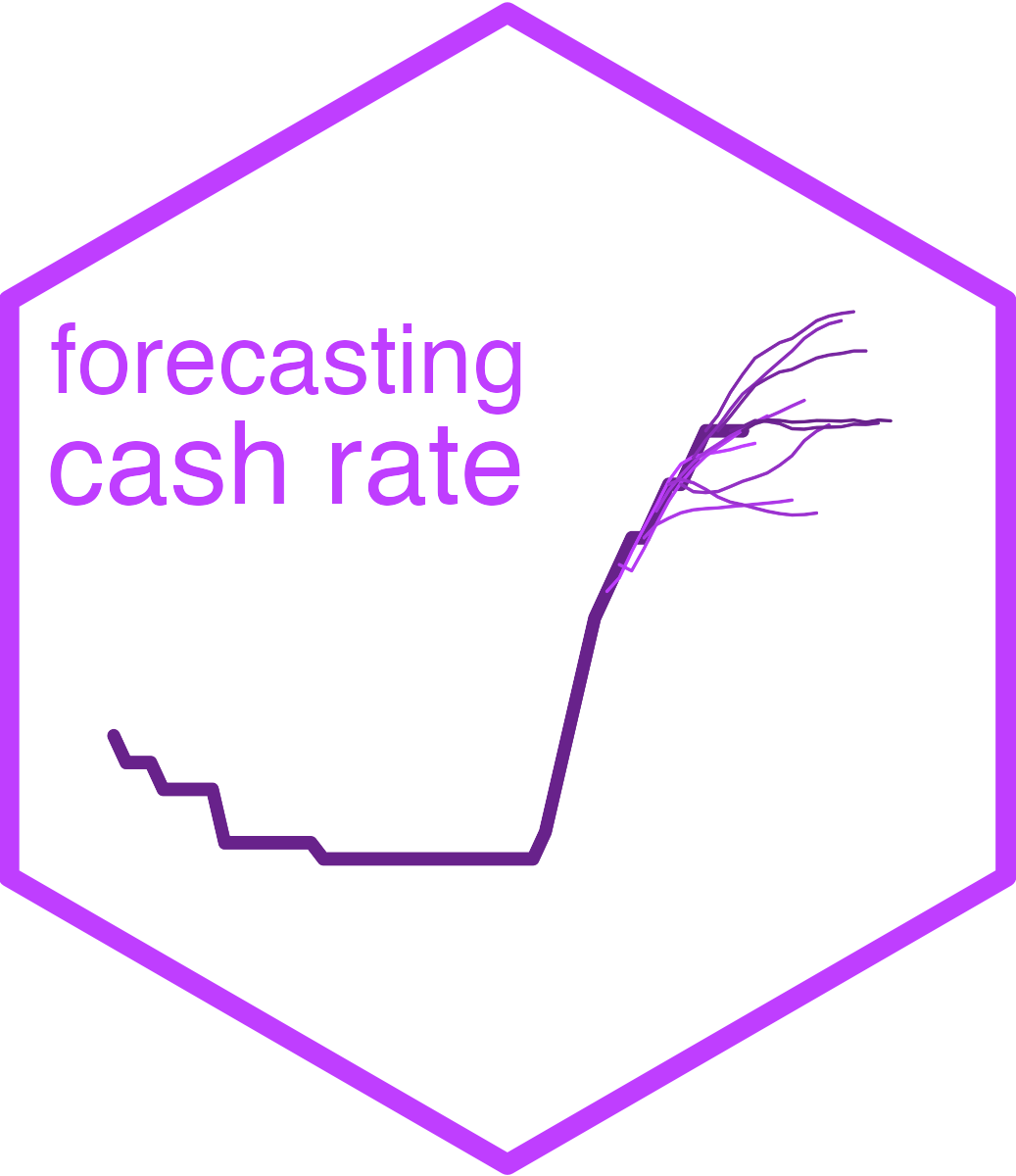

The figure below presents the monthly cash rate series starting from January 2010, with the forecasts reported from July 2023 to June 2024 as the forecast mean and the 68% forecasting intervals.

The table below makes the numerical values presented in the figure more accessible.

| monthly | lower | upper | |

|---|---|---|---|

| Jul 2023 | 4.22 | 4.14 | 4.32 |

| Aug 2023 | 4.42 | 4.27 | 4.59 |

| Sep 2023 | 4.59 | 4.37 | 4.82 |

| Oct 2023 | 4.73 | 4.46 | 5.03 |

| Nov 2023 | 4.81 | 4.45 | 5.18 |

| Dec 2023 | 4.88 | 4.46 | 5.32 |

| Jan 2024 | 4.91 | 4.43 | 5.43 |

| Feb 2024 | 5.00 | 4.46 | 5.59 |

| Mar 2024 | 5.08 | 4.48 | 5.73 |

| Apr 2024 | 5.13 | 4.48 | 5.84 |

| May 2024 | 5.15 | 4.46 | 5.94 |

| Jun 2024 | 5.17 | 4.42 | 6.01 |

Survey answers

Based on the forecasts above, and the analysis of forecasts from individual models, I formed the following survey answers:

When you think the RBA will change the cash rate?

| Jul 2023 | Aug 2023 | Sep 2023 | Oct 2023 | Nov 2023 | Dec 2023 | Feb 2024 | Mar 2024 | Apr 2024 or later | |

|---|---|---|---|---|---|---|---|---|---|

| Increase | ✓ | ✓ | |||||||

| Decrease |

Why do you think this?

Despite the lower reading of monthly inflation in June at 5.3%, my forecasts tell the same story as last month. They indicate a 15 basis point rise in the cash rate, with further increases expected throughout the year. The narrow forecast interval, spanning the values from 4.16 to 4.34%, leaves little doubt about the projected raises.

By how much do you think the RBA will change the cash rate in the next meeting?

15 pbs

At what level do you think the cash rate will peak?

4.25%

When do you think the cash rate will peak?

August 2023

RBA’s decision

On 4 July 2023, the RBA announced no change in the cash rate target.

Forecasting system

My forecasting system for June is based on the cash rate target and government bond yields at various maturities as presented in the figure below.

The system consists of a hundred of models. Half of them are Vector Error Correction models for weekly and monthly series with different model specification parameters. This month, for the first time, I did not use models with the dummy variable for th recent cash rate hike period and assuming this regime over all forecasting horizons.

The other half of models includes univariate specifications for the cash rate capturing complex patterns of data persistence using autoregressive moving average equation extended by time-varying volatility equation - a GARCH model. Part of the models include the leverage effect and/or time-varying risk premium. The best fitting models are with the richest dynamics, that is a (3,3) ARMA order, the GARCH equation with the leverage and in-mean effects. The data is plotted below.